Builder Selection (Part 2) – Pre-Qualification, Vetting & Red Flags

We began this two-part series looking at the process of seeking a builder for your home extension or renovation project. We mentioned some of the information you should provide when requesting quotations and the correct stage for making those requests, as well as who to ask and how to appoint. In case you missed it and would like to read that first, you can check it out here – ‘Builder Selection (Part 1) – When, What, Who, How?’

We’re now going to delve into pre-qualification and vetting methods, some, or all of which you might like to adopt when considering which builders to work with, depending on the size of your project, your procurement method, and the level of professional involvement.

What is a Pre-Qualification Questionnaire (PQQ)?

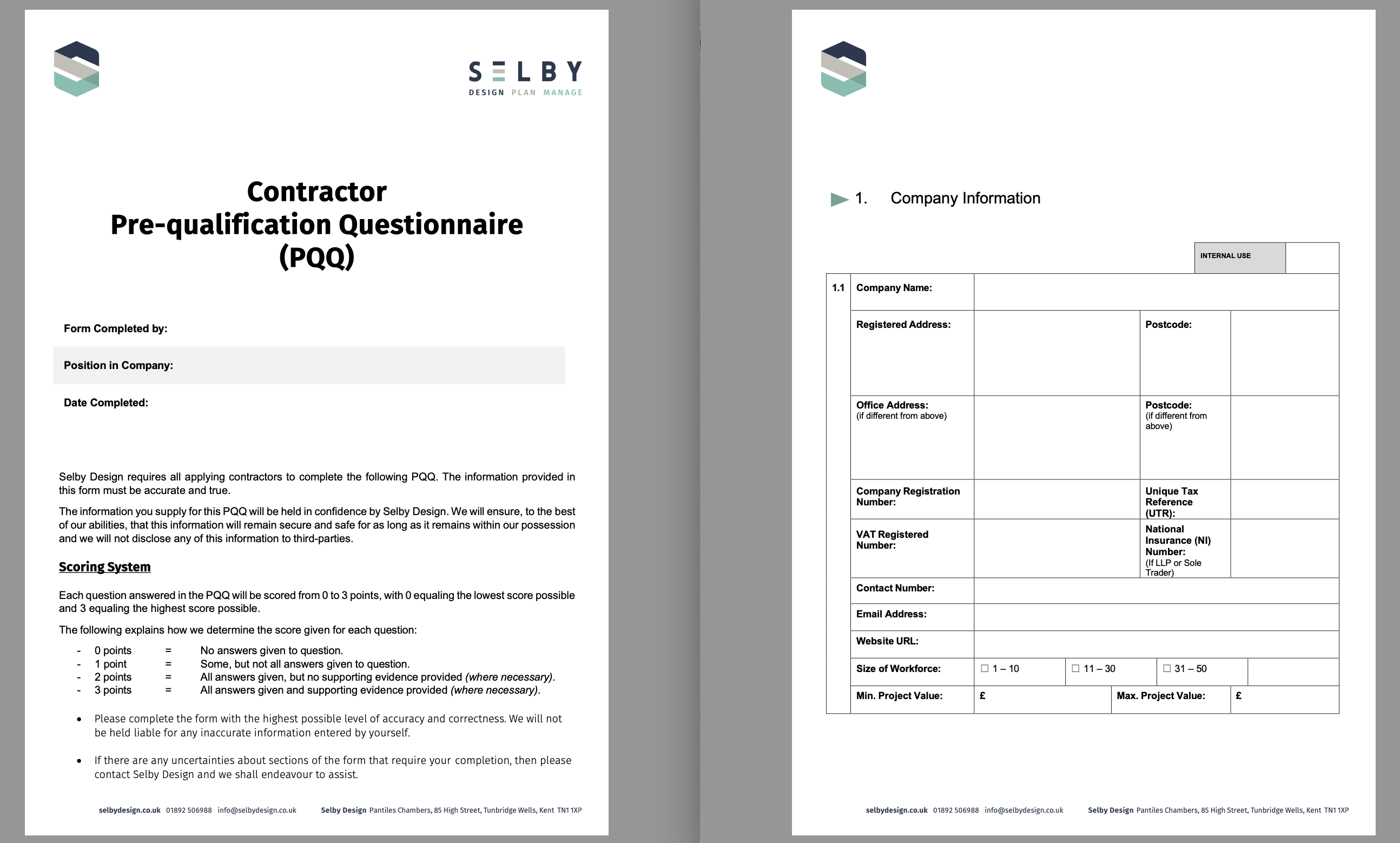

When preparing to approach builders in request of quotations for your building project, it’s best practice to use a pre-qualification questionnaire (PQQ), typically prepared and issued by the person in control of the tender stage. The purpose of this questionnaire is to identify those contractors most suitable to tender for your project, determined by asking a series of questions regarding business details, experience, references, capability, and capacity.

With the assistance of your Architect/Design Consultant/Contract Administrator, the answers to the questions set out in the PQQ will be reviewed and scored, and the results used to form a contractor shortlist in preparation for sending out tender invitations.

Adopting this method of pre-qualification reduces the likelihood of wasting client and contractor time, in processing and assessing inappropriate tenders, and is more likely to result in comparative returns.

Contractor Vetting

When carrying out due diligence as a client/employer of construction services in relation to a home extension or renovation project, the level of vetting should be proportionate to the scale of the project and the work involved. The use of a PQQ will cover most key factors, but we’ll review a few of the main ones separately here, should you decide not to adopt the use of a formal and managed tender process.

Accreditations

One way of measuring the competency and credentials of a builder, is to check whether they have any accreditations or are members of any organisations that set conduct guidelines, and who audit and monitor adherence. The Federation of Master Builders (FMB), National House Building Council (NHBC) and TrustMark are a few common examples, but it’s worth looking into the criteria each one uses for vetting and auditing members, as some are better than others. Again, you’ll need to decide whether the guidelines and level of vetting is adequate for the scale of the project.

Reviews & References

There are several websites that can be used to search for and check the experience of a builder, such as Checkatrade, MyBuilder and Rated People, but the ‘checking’ criteria used by some of these paid for memberships is generally less stringent than the organisations listed above. It’s also important to be wary of any manipulated ratings and fake reviews, so these websites should only form a small portion of your vetting and consideration when making contractor selections.

Genuine client to client references are one of the best ways of determining the skills, experience, and limitations of a particular contractor. Most reputable builders will be proud of their portfolio of completed projects and usually those clients, dancing with joy in their new home extension, will be happy to share their experience with you. That could be via a telephone call or an invitation into their home to look at completed work first hand. This also gives you an opportunity to ask questions like; Would you use this builder again? Were they tidy and punctual? Did they communicate any issues or changes with you in a timely manner? Were the agreed deadlines met?

Insurances

It’s important to check that the types of insurance and the cover limits held by those contractors you are considering, are suitable for the type and scale of your project. For medium to large home extension projects, we would typically expect contractors to have a Public Liability indemnity limit of £5million and a Contract Works indemnity limit that is equal to or higher than the total contract value of the project in question. Based on our own experience of insurance responses in the pre-qualification stage, it is quite common to find contractors who don’t have sufficient Contract Works cover, especially as you begin to get into project values over £150k. It is also important to check that the business description and activities stated on the policy accurately describes the work that the contractor is planning to carry out on your home.

Whilst on the topic of insurance, it is also worth pointing out that before proceeding with any construction work, you will need to inform your own insurer and confirm that insurance of the existing structure will remain in place whilst any work is in progress. In most cases this will not be an issue, but occasionally you may be asked to take out a joint names policy. The insurer will ask you to describe the proposed works, provide the intended start date and end date, the form of contract being used (with JCT Minor Works contracts often being preferred), the length of the defects rectification period and the contract value.

As I’m sure you can imagine, the intricacies of the insurance arrangements in place can become quite complex and when we consider that for most people, a home is their most expensive asset, it’s important to understand the cover and what would happen in the event of a claim. To ensure that there are no holes in the policies, it is advisable to work with an insurance broker who is well-versed in renovation insurance.

Financial Stability

The relevance and importance of a contractor’s financial stability will largely depend on the scale of the project, the form of contract and the intended payment procedures. Companies House is a good starting point and a reliable source of information, providing you with the financial standing of a business. A financially stable builder will have the funds and the credit rating needed to source the materials and have them delivered and put together to complete your project.

If the builder has been established for a long time, then whilst this is certainly no guarantee of financial standing, it does increase the chances of them having good lines of credit with suppliers.

It is also worth considering carrying out your own credit checks on builders when vetting them for your home extension or renovation project. A good credit score may demonstrate that the builders are paying their bills on time. A report will also show any outstanding debt that the business might have and how it has been using available credit.

Red Flags

Requesting payment upfront – any form of payment in advance has the potential to carry some risk, but this largely depends on the project value, contract type and payment schedule as to the level of that risk. Most well established and reputable, medium to large contractors will not require payment upfront. Instead, adopting a payment schedule with monthly valuations and payments is advisable. Cash payments upfront are obviously an absolute no, no!

Not wanting to sign a recognised contract – you would think this was quite obvious, but still it surprises us how many homeowners instruct work on their homes without a suitable contract. At a very basic level, the contract should include a detailed quotation, a start date and end date, a payment schedule, and the insurance arrangements. Some industry recognised contracts to consider using would be the JCT Minor Works Contract or Homeowner Contract, RIBA Domestic Building Contract and the FMB Contract.

Approaching you in search of work – as you begin embarking on your project, you might be approached by builders directly offering their services. This is often a result of trawling local planning applications in search of upcoming approvals. This doesn’t necessarily signify a bad, or ‘cowboy’ builder of course, but if you have ever made an enquiry to a good local builder, then you’ll know that they are generally booked up for some time.

Having no premises – if they do not have a verifiable business address and landline phone number, the opportunity for them to ‘disappear’ is obviously greater.

Lacking references – if the builder is cagey about referrals, and your requests for details of completed projects are brushed off, then this is a red flag. If they’re unable to provide contact details along with some project photos for context, then the likelihood is customer satisfaction is low.

Quotation seems too cheap – it’s as the saying goes; if something seems too good to be true, then it probably is! Always make sure you get at least three quotations, to give you a good idea of the cost range, and if your project is larger, you might also consider using an independent estimator or quantity surveyor who will be able to provide an itemised quote based on the current market averages for labour rates and materials. And remember, a quotation lacking detail is an opportunity for additional charges during the build.